Simply Smarter Technology

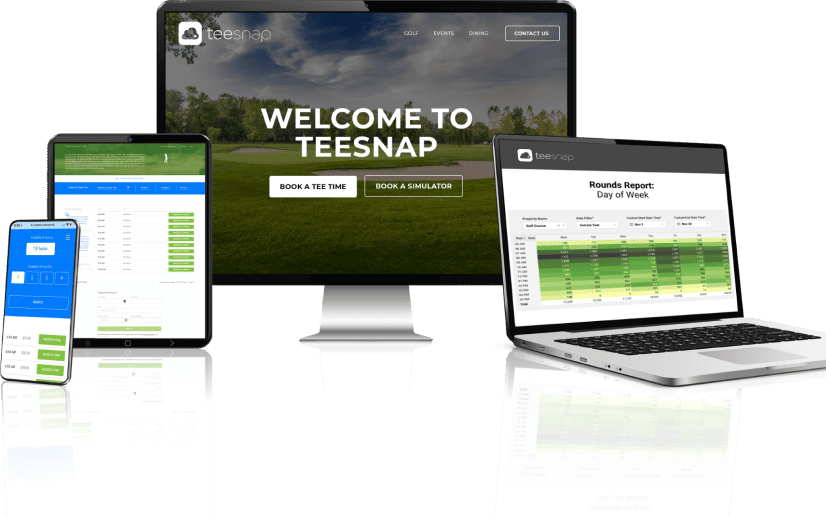

Streamline Your Golf Course Management with Our All-in-One, Easy-to-Use Platform.

Solutions & Services

Tee Sheet Management

Freedom to be in Control

Break free from the constraints of outdated or manual systems. Teesnap offers real-time, tablet-based tee sheet management that can be updated on-the-fly. Your team stays agile, you stay in control and your golfers stay engaged.

Point of Sale

Technology You Can Count On

Uptime is not a luxury with Teesnap, it is part of our promise. Seamlessly toggle between Wifi and Cellular connections, our cloud-based application keeps your business running and you in control 24/7. And with Teesnap, innovation is constant. Stay in control and a step ahead.

Marketing & Customer Experience

Winning Customers, Driving Loyalty

Say goodbye to convoluted marketing platforms. Teesnap integrates user-friendly marketing tools directly into the Tee Sheet. Send personalized marketing or reach new audiences, Teesnap keeps you connected and consumers engaged.

Snap Reservations - Simulator Booking

Turn off off-season and power your simulator reservations with Teesnap – Snap Reservations. Teesnap’s Snap Reservations feature integrates simulator bay reservations directly into your Teesnap point of sale.

Teesnap: Golf Course Marketing

Teesnap Golf Course Marketing provides golf courses with a full-service marketing team. From optimized website experiences, email marketing campaigns, social engagement and more, let Teesnap help you drive rounds and revenue.

Golf Course Marketing by Teesnap provides golf courses with a full-service marketing team.

From optimized website experiences, email marketing campaigns, social engagement and more, let Teesnap help you achieve your marketing objectives.

Unlock the full potential of your golf course with Teesnap.

Our suite of solutions and services provide you with effective marketing, seamless mobility and straightforward operations.

Trusted by Hundreds of Golf Courses

Worthington Manor

11 US Open Qualifiers & 2019 Maryland Open

Cooper’s Hawk Golf Course

#1 Public Golf Course in Arkansas

Denison Golf Club

Classic Donald Ross Design

Got Questions About Teesnap?

We've got answers.

Teesnap makes golf management simple. Even implementation is easy as our dedicated support team will oversee your data migration and will provide comprehensive training. Your course can be ready to go in days – it’s that easy.

Absolutely! Teesnap is designed to manage every facet of golf course operations. From tee sheet management to a fully integrated F&B POS system, we’ve got everything covered in one unified platform.

Teesnap delivers easy to use technology, 7-days per week Support, and a dedicated customer success representative to make sure you are getting the most value out of the Teesnap tools.

Teesnap offers a powerful suite of marketing tools tailored for golf courses. From targeted email campaigns to insights on customer preferences and behaviors, the platform equips you with everything you need to boost bookings and enhance customer loyalty. Plus, Teesnap offers courses a full-service digital marketing team.

What Our Clients Say

Hear from some of the top golf courses that have elevated their operations and profitability with Teesnap.